We use cookies to provide you with the best possible online experience. Read our cookie policy.

MEDIA RELEASE

6 MARCH 2024

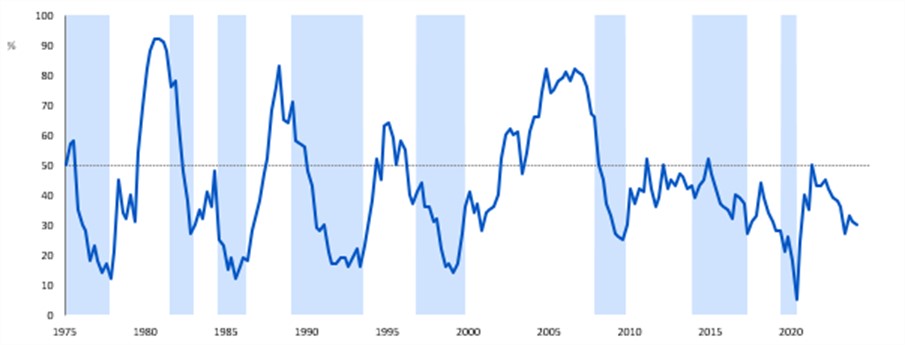

RMB/BER Business Confidence Index stuck at a low level

Following a two-point decline in the fourth quarter of 2023, the RMB/BER Business Confidence Index (BCI) ticked down by another point to reach 30 in the first quarter of 2024. This means that seven out of ten survey respondents are unsatisfied with prevailing business conditions. Taking a slightly longer perspective shows a concerning picture as less than four out of ten survey respondents were satisfied with prevailing business conditions for seven consecutive quarters. Business confidence was, again, largely unchanged among building contractors and wholesalers. Declines in sentiment in the retail and manufacturing sectors outweighed a ten-point improvement among new vehicle dealers.

RMB/BER Business Confidence Index (BCI)

Source: BER, SARB (Shaded areas represent economic downswings)

Broadly speaking, business activity remained poor while business conditions deteriorated further. As was the case in the fourth quarter of 2023, this result went against survey respondents’ expectations for an improvement. Remarks about the negative impact of load-shedding, the state of the local ports, crime, and political uncertainty featured prominently in the feedback from survey participants. Another noteworthy development was an acceleration in selling price inflation across the board. Except for retail, the increases were relatively muted, but it does signal that there is an upside risk to the inflation outlook.

Details

Building contractors were once again the least pessimistic of all sectors surveyed (in Q4, wholesalers temporarily took the ‘top spot’ – see the table below), with business confidence ticking up by one index point to 42. Main contractor activity was somewhat better than in the fourth quarter of last year. That said, the underlying data does suggest that, following a short-lived surge in activity from the third quarter of 2022 onwards, growth in building activity normalised from the end of 2023 into the first quarter of 2024.

The other two sectors where confidence improved were wholesalers and new vehicle dealers. Wholesale confidence nudged up by one index point to 37, which is equal to the average reading seen in the second half of 2023. Sales volumes of consumer goods looked significantly better this quarter. Meanwhile, new vehicle dealers saw confidence jump up by ten points to 16, but this was not enough to reverse the 24-point decline in Q4. Indeed, new vehicle dealers remain the most depressed of all sectors surveyed indicating a consumer squeeze from high interest rates.

A 13-point decline in retail confidence countered the improvements in wholesale and new vehicle dealers. Total sales volumes were better in the first quarter on the back of significantly less negative non-durable goods sales and a surprisingly solid uptick in semi-durable goods sales volumes. However, durable goods sales deteriorated once more – particularly on the hardware side. Overall profitability also came under pressure which likely weighed on confidence.

Another drag on the composite RMB/BER BCI came from manufacturers, which saw confidence fall by five points to 21, which is equal to the average confidence reading of 2023. A weakening in activity as well as both domestic and export demand explains the deterioration in confidence. Worryingly, respondents turned even more downbeat about investment and business conditions going forward.

Business confidence per sector (2022Q1-2024Q1)

|

% |

22Q1 |

22Q2 |

22Q3 |

22Q4 |

23Q1 |

23Q2 |

23Q3 |

23Q4 |

24Q1 |

|

RMB/BER BCI |

45 |

42 |

39 |

38 |

36 |

27 |

33 |

31 |

30 |

|

Building contractors |

25 |

46 |

29 |

46 |

43 |

43 |

41 |

41 |

42 |

|

Wholesale |

56 |

58 |

50 |

37 |

40 |

32 |

38 |

36 |

37 |

|

Retail |

49 |

49 |

51 |

42 |

34 |

20 |

32 |

47 |

34 |

|

Manufacturing |

43 |

28 |

26 |

26 |

17 |

17 |

23 |

26 |

21 |

|

New vehicle dealers |

54 |

29 |

40 |

41 |

44 |

23 |

30 |

6 |

16 |

Source: BER

Bottom line

According to the data released by Stats SA yesterday, real GDP was stagnant in the fourth quarter of 2023, registering 0.1% quarter-on-quarter growth following a contraction of 0.2% in the third quarter. For the full 2023, economic growth averaged 0.6% from 1.9% in 2022. While the economy escaped slipping into a technical recession, the performance remains uninspiring.

Unfortunately, the RMB/BER BCI results do not signal an improvement at the start of this year. On the contrary, as outlined by Isaah Mhlanga, Chief Economist and Head of Research at RMB, business conditions deteriorated further in the first quarter. Mhlanga states that “the same supply constraints, including load-shedding, logistical challenges, and heightened global and domestic policy uncertainty, keep South African businesses in a stranglehold. Another drag comes from lacklustre demand which is insufficient to sustain production and trade sales volumes at a higher level. A temporary surge in building activity also seems to be fading”. Looking further ahead, the expectation of moderating inflation (albeit with the survey showing some near-term upside risks) and possibly lower borrowing costs due to an expected shallow cutting cycle of the policy interest rate may help with local consumer demand in the second half of the year. While there has been some positive movement on alleviating some supply-side pressures, particularly energy due to private sector investments, much more needs to be done in implementing economic reforms that can generate the kind of economic growth that can pull along non-energy investment, lift sentiment and generate employment.

End.

Enquiries:

Isaah Mhlanga

Chief Economist and Head of Research

Tel: 073 736 7357/ 011 283 1460