We use cookies to provide you with the best possible online experience. Read our cookie policy.

Media Release

4 September 2024

Further increase in the first post-GNU

RMB/BER Business Confidence Index (BCI) in the third quarter of 2024

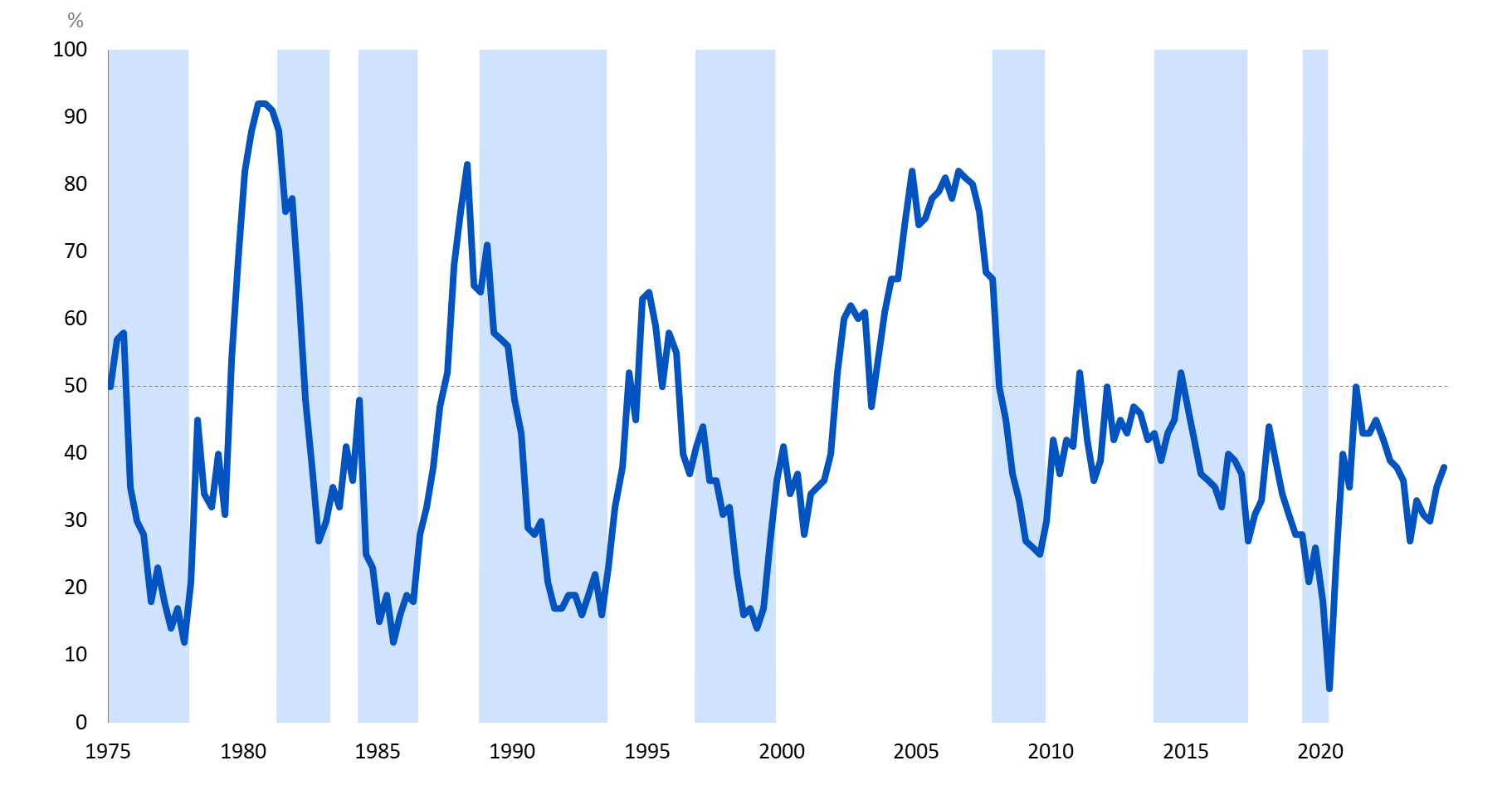

Following a five-point increase in the second quarter, the RMB/BER Business Confidence Index (BCI) rose by another three points to reach 38 in the third quarter of 2024. [1] This is the first business sentiment survey in South Africa following the formation of the Government of National Unity (GNU) and reflects cautious optimism about improving business conditions. Although respondents still noted constraints, especially weak demand, they were less negative about current conditions and encouragingly, were more upbeat about business conditions going forward. For the first time since early 2022, a slight net majority of respondents across the different sectors expect business conditions to improve in the next quarter.

RMB/BER Business Confidence Index (BCI)

Source: BER, SARB (Shaded areas represent economic downswings)

Details

The three-point increase brought the composite RMB/BER BCI to the best level since the fourth quarter of 2022, when confidence was also at 38 points. At the current level, just under four out of ten respondents were satisfied with prevailing business conditions. Of the five sectors making up the BCI, wholesalers and building contractors saw a decline in confidence (although remaining at relatively high levels), manufacturing remained unchanged, and retailers and new vehicle dealers showed an improvement in confidence.

Business confidence per sector

|

% |

LT avg |

23Q1 |

23Q2 |

23Q3 |

23Q4 |

24Q1 |

24Q2 |

24Q3 |

|

RMB/BER BCI |

44 |

36 |

27 |

33 |

31 |

30 |

35 |

38 |

|

Wholesale |

45 |

40 |

32 |

38 |

36 |

37 |

53 |

51 |

|

Retail |

39 |

34 |

20 |

32 |

47 |

34 |

39 |

45 |

|

Building contractors |

44 |

43 |

43 |

41 |

41 |

42 |

47 |

41 |

|

Manufacturing |

36 |

17 |

17 |

23 |

26 |

21 |

28 |

28 |

|

New vehicle dealers |

43 |

44 |

23 |

30 |

6 |

16 |

10 |

27 |

Source: BER

New vehicle dealers registered the biggest increase in confidence, rising by a solid 17 points to 27 in the third quarter, a one-year high. However, despite the big surge, the sector remains the most pessimistic with less than three in ten respondents satisfied with prevailing business conditions. Business confidence in the sector has been extremely depressed over the last three quarters, with less than two in ten surveyed respondents satisfied with prevailing business conditions. Be that as it may, the sector seems to have bottomed and is slowly recovering. Moderating inflation and the associated reduction in policy interest rates should provide a boost to household disposable income and support the uptick.

Despite a two-point drop from the second quarter, the wholesale trade was still the most optimistic sector surveyed, with just over half of respondents satisfied with prevailing business conditions. At 51%, this is six points better than the long-term average reading of 45%, which is supported by the underlying data that generally reflects upbeat conditions. While total sales volumes were unchanged from the second quarter, underlying trends moved in opposite directions. Wholesalers of consumer goods noted lower sales relative to the second quarter, albeit still performing better than the long-term average. On the other hand, wholesalers of non-consumer goods reported that sales performed better relative to the second quarter, with volumes now in line with the long-term average reading.

Retail trader confidence improved from its long-term average of 39 index points to an above-average 45 index points in the third quarter. While actual retail sales volumes could be somewhat lower in the third quarter of 2024 compared to the strong sales seen during the same period in 2023, durable and semi-durable traders' sales volumes improved in the third quarter while that of non-durables declined.

The outcome for building contractors was a bit more disappointing as confidence fell by 6 points to 41 index points after a five-point increase in the second quarter. The current level is roughly in line with the confidence readings seen through 2023. A recent trend of outperformance by the non-residential sector continued in the third quarter, with the residential sector under significant pressure.

Finally, confidence in the manufacturing sector remained unchanged at 28 index points amid a general improvement in the assessment of current business conditions. However, conditions in the manufacturing sector deteriorated, with a decline in export and domestic demand contributing to a decline in production. Most notable was a significant decline in the seriousness of the general political climate as a constraint on business and investment decisions. Indeed, forward-looking investment outlays turned notably more positive in the third quarter.

Bottom line

The improvement in sentiment was likely supported by a continued absence of electricity supply disruptions and political certainty following the May 29 election. However, with continued pressure on local consumers observed across the sectors and sluggish export demand noted by manufacturers, there was not enough demand to fuel a faster uptick in sentiment. Indeed, broadly speaking, activity did not materially improve compared to the second quarter. Data released by Statistics South Africa (Stats SA) showed a slight expansion of 0.4% quarter-on-quarter in GDP in the second quarter after a (revised) flat performance in the first quarter. Another positive outcome is likely in the third quarter, but a recovery in demand is required to get momentum going. As per Isaah Mhlanga, chief economist at RMB, “Fortunately, the widely anticipated interest rate cut in South Africa later this month, on the back of lower consumer inflation and a boost from the introduction of the two-pot retirement system should spur domestic demand through the remainder of the year. This should benefit sentiment, but logistical constraints remain top of mind and will need to be urgently tackled to support a sustained lift in business confidence”. The improvement in the forward-looking investment indicator is encouraging and would provide a real impetus to economic growth, but we need to see higher confidence for this to materialise.

[1] Note that the fieldwork for the 2024Q2 BCI took place from 9 to 27 May 2024, so before the 29 May national and provincial elections. The fieldwork for the 2024Q3 survey was from 7 to 26 August.

Enquiries

Isaah Mhlanga

Chief Economist

Tel: 073 736 5757 / 011 282 1460

Isaah.Mhlanga@rmb.co.za