We use cookies to provide you with the best possible online experience. Read our cookie policy.

Press release

RMB/BER BCI shows that business sentiment is on the mend

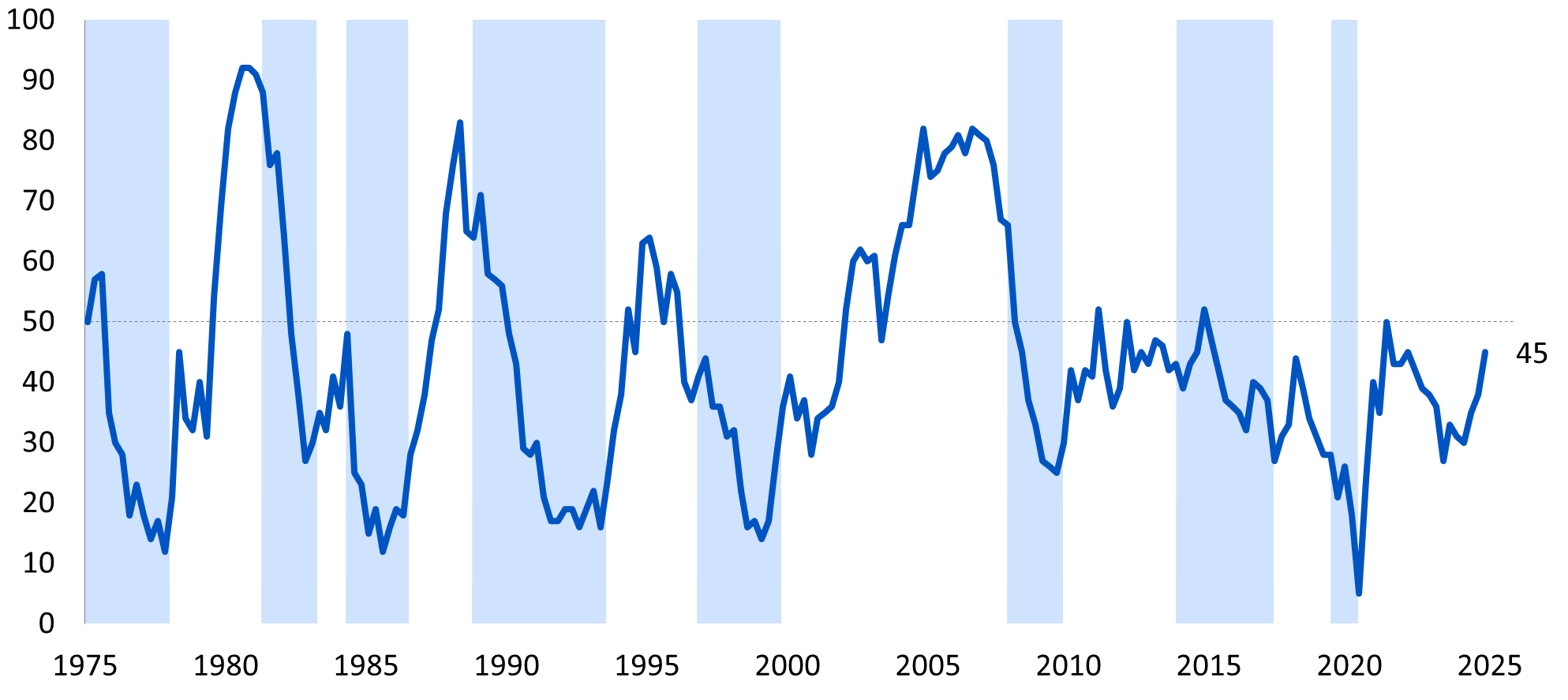

The RMB/BER Business Confidence Index (BCI) rose to 45 index points in the fourth quarter of 2024, up from 38 in the third quarter[1], meaning that just under half the respondents are satisfied with prevailing business conditions. This was the third consecutive increase, which now puts the index almost 20 points above a recent low of 27 reached in the second quarter of 2023. Encouragingly, the rise in sentiment was supported by an improvement in activity and better business conditions relative to the third quarter. Furthermore, respondents are upbeat about business conditions in the next quarter.

Confidence is now at its joint (along with the first quarter of 2022) best level since the second quarter of 2021, when it stood at 50 index points, and is just above its long-term average level of 43 index points.

RMB/BER Business Confidence Index (BCI)

% satisfactory

Source: BER, SARB (Shaded areas represent economic downswings)

Details

The uptick in the RMB/BER business confidence index was broad-based, with new vehicle dealers the only one out of the five sub-sectors that saw a decline in confidence while all the others improved. Even more encouraging is that all sectors have confidence readings at or above their long-term average levels, except for new vehicle dealers. Furthermore, three of the subsectors – wholesale, retail and building contractors – have confidence above the 50-neutral level.

Business confidence per sector (in order from highest to lowest in 2024Q4)

|

% |

LT avg |

23Q1 |

23Q2 |

23Q3 |

23Q4 |

24Q1 |

24Q2 |

24Q3 |

24Q4 |

|

RMB/BER BCI |

43 |

36 |

27 |

33 |

31 |

30 |

35 |

38 |

45 |

|

Wholesale |

45 |

40 |

32 |

38 |

36 |

37 |

53 |

51 |

60 |

|

Retail |

40 |

34 |

20 |

32 |

47 |

34 |

39 |

45 |

54 |

|

Building contractors |

43 |

43 |

43 |

41 |

41 |

42 |

47 |

41 |

51 |

|

Manufacturing |

36 |

17 |

17 |

23 |

26 |

21 |

28 |

28 |

36 |

|

New vehicle dealers |

41 |

44 |

23 |

30 |

6 |

16 |

10 |

27 |

23 |

Source: BER

Business confidence among wholesalers rose by a solid 9 points to 60, following a slight downtick in the third quarter. This is the highest reading since the second quarter of 2021 when confidence reached 62 points. Consumer goods wholesalers underpinned the improvement and generally assessed business conditions to be better than they were this time last year, with scope for further improvement in the first quarter of next year.

This aligns with the experience in the retail sector, where confidence rose to 54 points in the fourth quarter, up from 45 in the third quarter. Remarkably, for the first time since 2007, a slight net majority of respondents reported business conditions to be better relative to the same period in the previous year. Retailers are even more upbeat about business conditions next quarter. The higher confidence is supported by a solid improvement in sales volumes. The start of an interest-rate cutting cycle, lower inflation, and improving consumer sentiment all support a recovery in demand, with cash withdrawals from the recently introduced two-pot retirement system providing a further boost to spending.

New vehicle dealers, however, do not share this optimism. Following a big increase in new vehicle dealers’ confidence in the third quarter, from an extremely subdued 10 points to 27, confidence slipped to 23 in the fourth quarter. While wholesalers and retailers are benefiting from an uptick in demand, the more interest-rate-sensitive new vehicle sales are still under pressure. That said, it seems like the low point for this sector has passed, with sales volumes trending up.

Sentiment among building contractors rose by a hefty 10 points to 51 in the fourth quarter, a level that is not only well above the long-term average of 37, but also the best level seen in 10 years. However, the higher interest rate environment is still holding back a stronger rebound in the residential building work, although confidence ticked up, supporting the increase.

Finally, business confidence in the manufacturing sector improved to 36 points in the fourth quarter after remaining unchanged at 28 points in the third quarter. This is the best level in three years, which is supported by higher domestic and export demand. Production also rose relative to last year. The most encouraging takeaway from the manufacturing survey results was that investment seems to be on the mend, with a higher net majority of respondents reporting an increase.

Bottom line

The slow, but steady increase in business confidence in recent quarters is an encouraging development. The continued absence of load-shedding and political stability following the May 29 election has helped with the recovery, while an improvement in consumer demand seems to have provided a further boost to sentiment in the fourth quarter. The latter largely benefited the retail and wholesale sectors, but manufacturers and building contractors also saw sufficient improvement in underlying business conditions and activity to warrant an uptick in confidence. In contrast, the more interest-rate-sensitive new vehicle dealers remain under pressure.

As per Isaah Mhlanga, chief economist at RMB, “The further improvement in business confidence is very welcome and is testament to the impact of the gradual improvement on the reform front. However, even though forward-looking indicators remain positive, more needs to be done to ensure that this recovery in confidence can be sustained and improved upon in coming quarters in order to eventually translate into higher investment, economic growth and job creation.” A common saying is that confidence is the cheapest stimulus for an economy, which makes the current uptick supportive for improved activity and investment down the line, however, we are not out of the woods yet. Respondents expressed concerns about red tape, high administrative costs and crime and corruption, especially flagging the construction mafia in the building sector. Like in the previous quarters, the logistical constraint remains severe, with a particular growing concern about the water crisis in Gauteng. As such, swift, committed, and continued efforts to implement the structural reforms, particularly in the logistics and water sectors, among others, are required to lift the constraints on the growth of South African economy that will go a long way in supporting a continued recovery in confidence, investment, economic growth, and much-needed job creation in due course.

[1] The fieldwork for the 2024Q4 survey took place from 24 October to 11 November.

Enquiries

Isaah Mhlanga

Chief Economist

Tel:073 736 5757 / 011 282 1460

Isaah.Mhlanga@rmb.co.za